Private Equity

Service Description:

We support clients through every stage of the investment cycle. Our primary solution and service are powered by AI. From shaping investment thesis and winning strategies to refining deal generation and sector screening, we ensure you’re on the right track. Post-acquisition, we help drive quick returns through strategic blueprints, management alignment workshops, and targeted initiatives.

We’ve also helped institutional investors and sovereign wealth funds build top-performing private equity, real estate, and infrastructure programs. As investors ourselves, we use our expertise to enhance your direct investment opportunities, leveraging proprietary tools like Pyxis, SPS, DealEdge, and OPEXEngine, for key insights and world-class capabilities.

Today, private equity is evolving rapidly, shaped by forces like virtual sales, digital innovations, a renewed focus on talent, and the rise of ESG (environmental, social, and governance) investing. Leading firms are embedding ESG into their operations, gaining market share as they meet demands for sustainable and socially responsible business practices.

With larger funds driving bigger deals, our deep expertise, advanced analytics tools, and proven track record will help you navigate these changes and achieve outstanding results.

Market Insight

As growth equity and venture capital investors recover while private equity stays muted, deals level out.

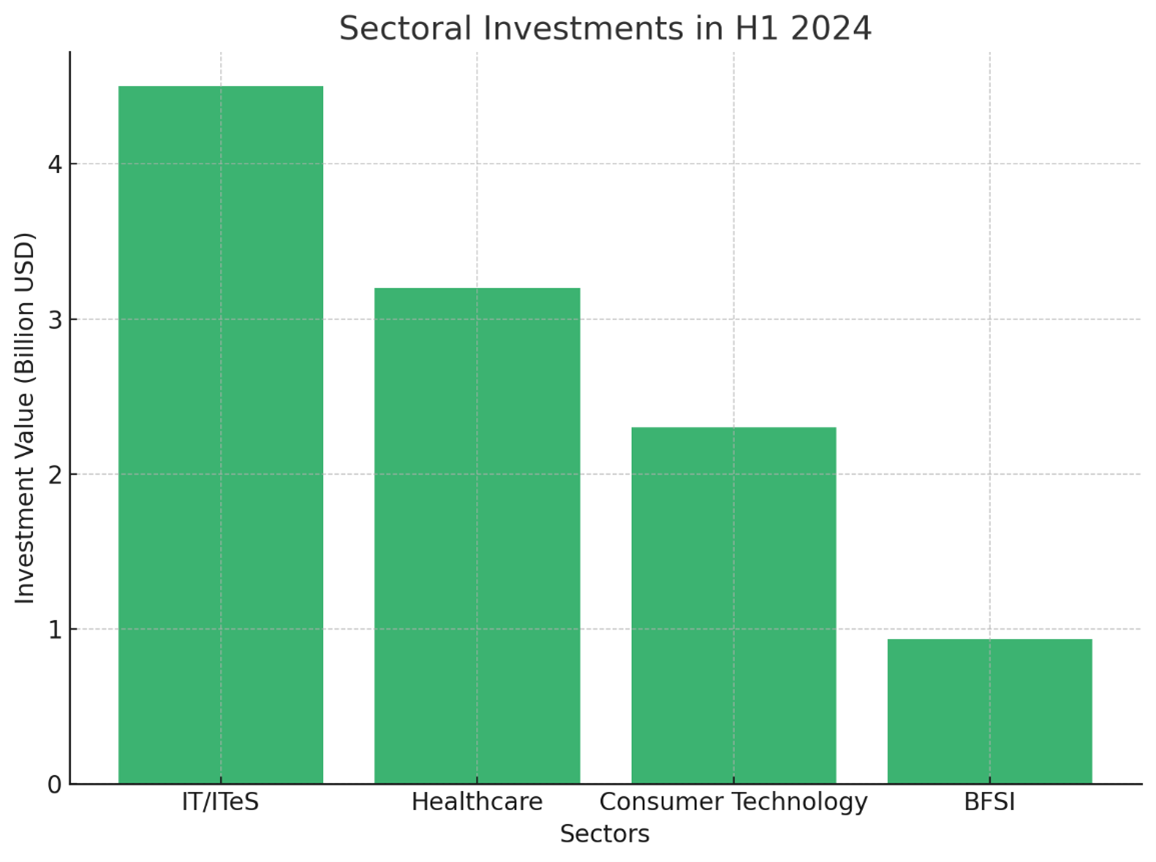

Here is the bar chart illustrating sectorial investments in H1 2024, with the IT/IT sector leading the way, followed by healthcare, consumer technology, and BFSI.

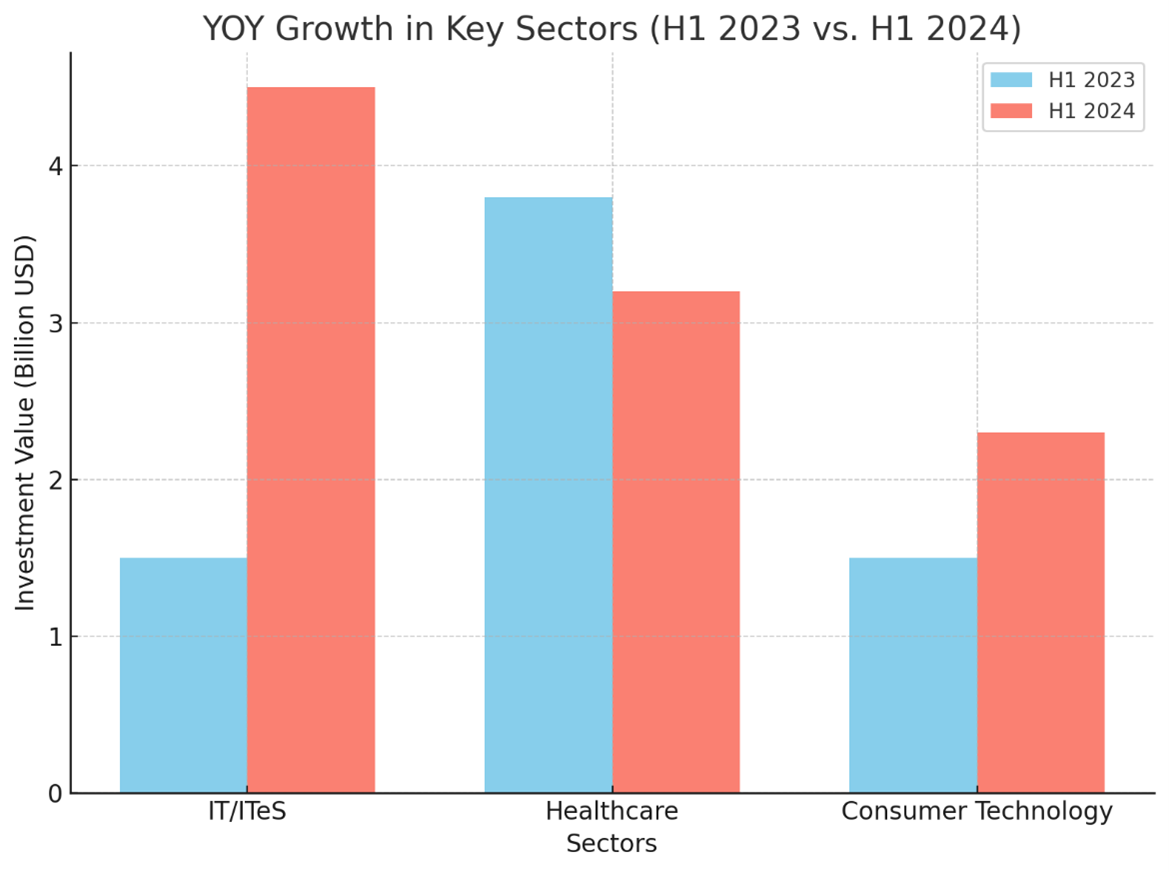

Here is the bar chart comparing the Year-over-Year (YOY) growth in key sectors from H1 2023 to H1 2024. It highlights the substantial growth in the IT/ITeS sector, with more modest changes in healthcare and consumer technology investments.

In the first half of 2024, India’s private equity (PE) and venture capital (VC) markets have shown signs of stabilizing, with cautious optimism driving steady investment levels of around $23–24 billion. This follows a period of correction in 2023 as the market recalibrated. A sectoral shift has been evident, with information technology (IT) and IT-enabled services (ITeS), healthcare, and consumer technology leading the charge.

The IT/ITeS sector saw a major resurgence, with investment reaching $4.5 billion in H1 2024, a dramatic increase from the $1.5 billion invested in all of 2023. IT/ITeS now holds a 25% share of total deal value, largely due to significant buyout deals, including EQT’s $3 billion investment in Perficient and TPG’s $0.9 billion in Altimetrik.

Consumer technology also experienced robust growth, with deal value rising 55% year-over-year (YoY) to $2.3 billion in H1 2024, driven by notable investments in companies like Zepto ($665 million) and Meesho ($275 million). The broader venture capital environment’s recovery bolstered this sector, as investors continue to support high-growth companies.

The healthcare sector maintained a 17% share of total deal value, despite a slight dip in overall investments, from $3.8 billion in H1 2023 to $3.2 billion in H1 2024. Medtech dominated healthcare deals, representing 35% of the sector’s deal value, with high-profile transactions like KKR’s $840 million investment in Healthium Medtech and Warburg Pincus’ $300 million in Appasamy.

In contrast, total PE deal value dropped by 10% YoY, from $19 billion to $17 billion, mainly due to a 20% decline in deal volume. However, there was a shift toward larger transactions, with the average deal size rising by 15% to $265 million. Buyouts became more prominent, increasing to 55% of total PE deal value, reflecting investors’ preference for acquiring control in high-quality assets across sectors like IT, healthcare, and consumer goods.

Global funds were particularly active, driving 75% of PE investments in India during H1 2024, with top global PE funds deploying $10 billion, surpassing 2023’s total of $8 billion. EQT was the most active investor, with over $3.5 billion invested in deals like Perficient and WSO2. Meanwhile, domestic funds accounted for 10% of the total PE deal value and saw successful fundraising, such as Kedaara’s $1.75 billion raise.

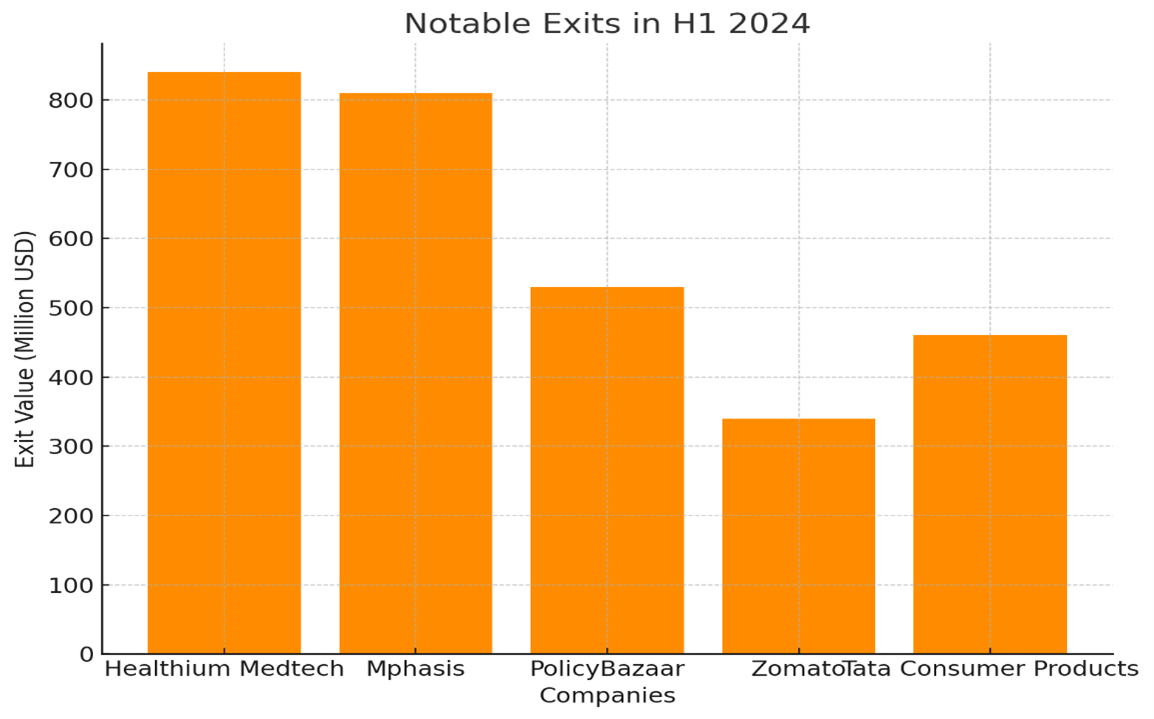

Exit activity in H1 2024 reached a six-year high, growing 40% YoY to $13.3 billion, with sectors like BFSI and healthcare driving 50% of total exit value. Notable exits included Healthium Medtech ($840 million) and Mphasis ($810 million). Public market and strategic sales were the primary exit routes, with the latter seeing a 3.5x increase from H1 2023, exemplified by Tata Consumer Products’ acquisition of Capital Foods ($460 million).

Exits in emerging tech sectors like consumer tech and fintech grew by 6 percentage points in H1 2024, driven by notable deals like PolicyBazaar ($530 million) and Zomato ($340 million). Public market sales became the leading exit route, rising to 55% of all exits, while strategic sales surged to $2.4 billion, with key transactions like Tata Consumer Products’ $460 million acquisition of Capital Foods.

Overall, H1 2024 marks a period of recovery and stabilization for India’s PE-VC landscape, driven by the rebound in venture capital and growth equity investments, strong exit activity, and renewed global interest. Looking ahead, the market is poised for further growth as investor sentiment remains cautiously optimistic, and a robust pipeline of deals and exits is expected for the second half of the year.

Our AI-integrated Solutions

Portfolio Value Creation

DealEdge

Institutional Investors

Sustainability in Private Equity

Firm Strategy and operations

Tech Due Diligence

Operational Due Diligence

Our experts

Our team of professionals includes HR consultants,

executive coaches, business professionals, and more.

-

Sanjay Dudani

Founder & CEOSanjay Dudani is Elaron’s Co-founder and CEO. An IIM Lucknow & NIT Calicut alum & backed by a...

view profile